Definition[]

A virtual currency system is a system in which transactions take place using virtual currency.

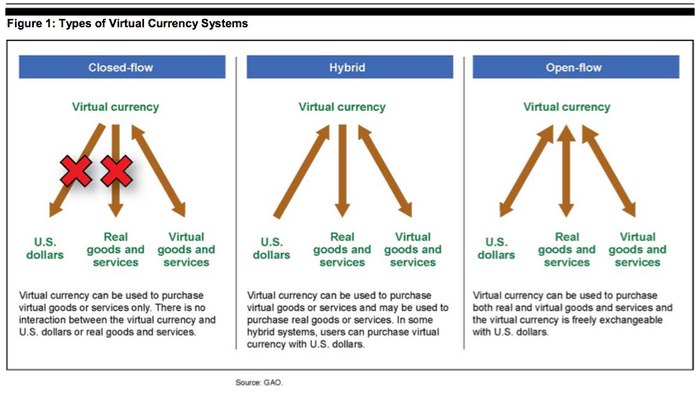

There are three types of virtual currency systems:

- In a "closed-flow" virtual currency system virtual currency can be used only to purchase virtual goods or services. An example of a closed-flow transaction is the purchase of items to use within an online game. Virtual tools amassed by players can be traded in a game for other in-game assets or to advance to higher play levels, but they hold no value outside of the game and cannot be cashed out for dollars or other government-issued currencies. It does not produce taxable income.

- In a "hybrid system" one or more flows between the virtual currency and real dollars or goods and services are closed. For example, participants can purchase virtual currency with real dollars or earn virtual currency by completing tasks, such as taking surveys, and then use the currency to purchase real or virtual goods and services. However, the virtual currency might not be exchangeable back into real dollars.

- In an "open-flow" virtual currency system, virtual currencies can be used to purchase both real and virtual goods and services, as well as be readily exchanged for government-issued currency, such as U.S. dollars. An open-flow currency can also be developed and designed primarily to be used to purchase real goods and services outside an online game virtual economy. As a result, it may produce taxable income.

Overview[]

Recent years have seen the development of virtual economies, such as those within online role-playing games, through which individual participants can earn and exchange virtual goods and services. Within some virtual economies, virtual currencies have been created as a medium of exchange for goods and services. Virtual property and currency can have economic value outside of virtual economies, such as when individuals trade these virtual goods for dollars or other government-issued currencies. More recently, virtual currencies have been developed outside of virtual economies as alternatives to government-issued currencies to exchange for real-world goods and services.

Tax issues[]

"Virtual economies and currencies pose various tax compliance risks, but the extent of actual tax noncompliance is unknown. Some identified risks include taxpayers not being aware that income earned through virtual economies and currencies is taxable or not knowing how to calculate such income. Because of the limited reliable data available on their size, it is difficult to determine how significant virtual economy and currency markets may be or how much tax revenue is at risk through their usage."[1]

References[]

Source[]

- Virtual Economies and Currencies: Additional IRS Guidance Could Reduce Tax Compliance Risks, at 1, 3-5.