Definitions[]

Bitcoin is

| “ | a virtual currency scheme based on a peer-to-peer network. It does not have a central authority in charge of money supply, nor a central clearing house, nor are financial institutions involved in the users perform all these tasks themselves. Bitcoins can be spent on both virtual and real goods and services. Its exchange rate with respect to other currencies is determined by supply and demand and several exchange platforms exist. The scheme has been surrounded by some controversy, not least because of its potential to become an alternative currency for drug dealing and money laundering as a result of its high degree of anonymity.[1] | ” |

Bitcoin "(capitalised) refers to both the open source software used to create the virtual currency and the peer-to-peer (P2P) network formed as a result; 'bitcoin' (lowercase) refers to the individual units of the virtual currency."[2]

Overview[]

Developed in 2009 by an anonymous programmer or programmers (using the pseudonym Satoshi Nakamoto), bitcoin is a privately-issued, open source (its controlling computer code is open to public view), peer-to-peer (transactions do not require a third-party intermediary such as PayPal or Visa), digital currency (being electronic with no physical manifestation) that exists only as a long string of numbers and letters in a user's computer file.

Bitcoins use cryptography to secure and safeguard against counterfeiting. Unlike U.S. dollars and other currencies, a bitcoin is not government issued and does not have a physical coin or bill associated with its circulation, such as a Federal Reserve note. Bitcoin has grown in popularity since its introduction and is the most widely circulated virtual currency available.

Like the U.S. dollar, the Bitcoin has no intrinsic value in that it is not redeemable for some amount of another commodity, such as an ounce of gold. Unlike a dollar, a Bitcoin has no physical form, is not legal tender, and is not backed by any government or any other legal entity, and its supply is not determined by a central bank. The Bitcoin system is private, but with no traditional financial institutions involved in transactions. Unlike earlier digital currencies that had some central controlling person or entity, the Bitcoin network is completely decentralized, with all parts of transactions performed by the users of the system.

Bitcoins act as a real world currency in that users pay for real goods and services, such as coffee or website development services, with bitcoins as opposed to U.S. dollars or other government-issued currencies.

How it works[]

Bitcoin is sometimes referred to as a cryptocurrency because it relies on the principles of cryptography (communication that is secure from view of third parties) to validate transactions and govern the production of the currency itself.

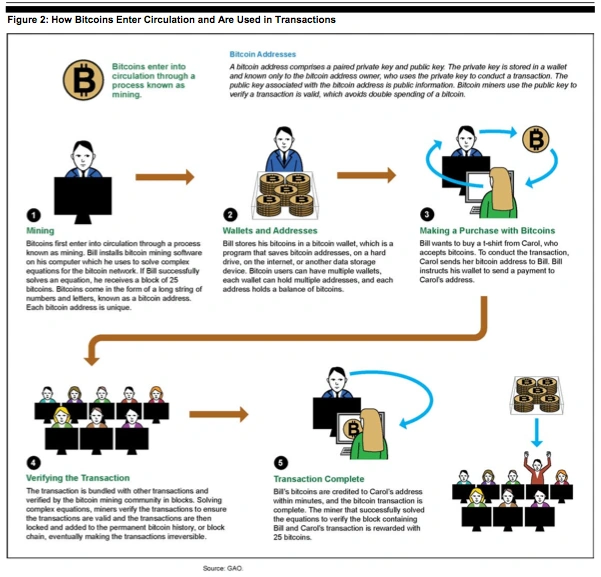

Bitcoins are created and entered into circulation through a process, called mining, that members of the bitcoin network perform. To perform the work of mining, bitcoin miners download free bitcoin software that they use to solve complex equations. These equations serve to verify the validity of bitcoin transactions by grouping several transactions into a block and mathematically proving that the transactions occurred and do not represent double spending of a bitcoin. When a miner's computer solves an equation, the bitcoin network accepts the block of transactions as valid and creates 25 new bitcoins and awards them to the successful miner.

By the bitcoin program's design, there will be a maximum of 21 million bitcoins in circulation once all bitcoins have been mined, which the program's design projects to be in the year 2140. In addition to mining new bitcoins, users can also acquire bitcoins already in circulation by purchasing them on third-party exchanges or accepting bitcoins as gifts or payments for goods or services. Figure 2 (below) shows an example of how bitcoins enter circulation and how an individual can use bitcoins to pay for real goods or services.

When a bitcoin is used in a financial transaction, the transaction is recorded in a public ledger (called the block chain or distributed ledger). The information recorded in the block chain is the bitcoin addresses of the sender and recipient. An address does not uniquely identify any particular bitcoin; rather, the address merely identifies a particular transaction.

Users' addresses are associated with and stored in a wallet. The wallet contains an individual's private key, which is a secret number that allows that individual to spend bitcoins from the corresponding wallet, similar to a password. The address for a transaction and a cryptographic signature are used to verify transactions. The wallet and private key are not recorded in the public ledger; this is where Bitcoin usage has heightened privacy. Wallets may be hosted on the web, by software for a desktop or mobile device, or on a hardware device.

This decentralized management of the public ledger is the distinguishing technological attribute of Bitcoin (and other decentralized cryptocurrencies) because it solves the so-called double spending problem (i.e., spending money you do not own by use of forgery or counterfeiting) and the attendant need for a trusted third party (such as a bank or credit card company) to verify the integrity of electronic transactions between a buyer and a seller. Public ledger technology could have implications not just for the traditional payments system but possibly also for a wide spectrum of transactions (e.g., stocks, bonds, and other financial assets) in which records are stored digitally.

Bitcoin transactions can be anonymous, since all that is needed to complete a transaction is a bitcoin address, which does not contain any personal identifying information. Only the private key holder knows the identity of the bitcoin address owner.

How are bitcoins obtained?[]

To interact on the Bitcoin network users first need to download the free and open-source software. Once connected to the network, there are three ways to obtain Bitcoins. First, a user can exchange conventional money (e.g., dollars, yen, and euros) for a fee on an online exchange (e.g., Okcoin, Coinbase, and Kraken). The exchange fee falls with the size of the transaction, ranging from 0.5% for small transactions down to 0.2% for large transactions.

The price of Bitcoin relative to other currencies is determined by supply and demand. In mid- January 2015, a single Bitcoin was valued at around $220. However, the price has been quite volatile, having been less than $20 in January 2013, above $1,100 in December 2013, and around $320 as recently as mid-December 2014 (representing more than a 30% fall in value in about one month).[3]

Second, a user can obtain Bitcoins in exchange for the sale of goods or services, as when a merchant accepts Bitcoin from a buyer for the sale of his product.

Third, as discussed above, a user can acquire new Bitcoins by serving as miner and applying his or her computer's processing power to successfully verify the validity of new network transactions. The probability of an individual discovering Bitcoins through mining is proportional to the amount of processing power that can be applied. This prospect is likely to be very small for the typical office or home computer. The difficulty of the verification problem increases so that Bitcoins will be discovered at a limited and predictable rate system-wide. But the increased difficulty of verification means that the computational cost of that service also rises.

Therefore, the supply of Bitcoins does not depend on the monetary policy of a virtual central bank. In this regard, despite being a currency with no intrinsic value, the Bitcoin system's operation is similar to the growth of money under a gold standard, although historically the amount of gold mined was more erratic than the growth of the supply of Bitcoins is purported to be. Depending on one's perspective, this attribute of the bitcoin network can be a virtue or a vice.

Currently, about 13.7 million Bitcoins are in circulation. However, the total number of Bitcoins that can be generated is arbitrarily capped at 21 million coins, which is predicted to be reached in 2140. However, because a Bitcoin is divisible to eight decimal places, the maximum amount of spendable units is more than 2 quadrillion (i.e., 2,000 trillion).[4]

Purchased or mined Bitcoins are thereafter stored in a digital wallet on the user's computer or at an online wallet service.

Are bitcoin transactions anonymous?[]

Bitcoin transactions are not truly anonymous.[5] An example of an anonymous transaction is an exchange for cash between two strangers. In this case, no personal information need be revealed nor does there need to be a record of the transaction. At the other extreme a non-anonymous transaction is a typical online purchase using a credit card. This transaction requires validation by a third-party intermediary to whom the buyer's and seller's identities and pertinent financial information is known by who maintains a record of the transaction. A Bitcoin transaction falls between these two extremes.

With a Bitcoin transaction there is no third-party intermediary. The buyer and seller interact directly (peer-to-peer), but their identities are encrypted and no personal information is transferred from one to the other. However, unlike a fully anonymous transaction, there is a transaction record. A full transaction record of every Bitcoin and every Bitcoin user's encrypted identity is maintained on the public ledger. For this reason Bitcoin transactions are thought to be pseudonymous, not anonymous.

Because of the public ledger, researchers have found that, using sophisticated computer analysis, transactions involving large quantities of Bitcoin can be tracked and claim that if paired with current law enforcement tools it would be possible to gain a lot of information on the persons moving the Bitcoins.7 Also, if Bitcoin exchanges (where large transactions are most likely to occur) are to be fully compliant with the bank secrecy regulations (i.e., anti-money laundering laws) required of other financial intermediaries, Bitcoin exchanges will be required to collect personal data on their customers, limiting further the system's ability to maintain the user's pseudonymity.

Legality and regulation[]

Different jurisdictions are taking vastly different approaches to Bitcoin and crypto-currencies. The landscape continues to evolve. The current regulatory framework, applicable to each national jurisdiction, can be found here.

The United States has taken the most pro-active measures, showing a willingness to actively engage industry groups and companies. This commenced in November 2013 with the first senate hearings into the cryptocurrency space. Tom Carper of Delaware presided over the hearings, which were led by the Foundation Bitcoin Foundation. The meetings functioned as a fact finding and introduction session for the Senate, who were largely uninformed up to that point.

The newly appointed Director of FinCEN: Jennifer Shasky was the most notable of presenters, because of her position. Her approach to Bitcoin and cryptocurrency was very mature. This lent what many saw as much needed legitimacy to the industry. Her positive remarks were of influence to the Senators.

Again in the United States, top financial regulators in New York have confirmed that proposed rules and guidelines will likely come in 2014. These will provide regulatory certainty for Bitcoin businesses operating within the state. This follows two days of hearings on digital currencies earlier in the year.

New York Department of Financial Services superintendent, Ben Lawsky, noted that this would see New York as the first U.S. state to create such a regulatory framework specific to Bitcoin and crypto-currencies. Given the state's standing in global financial markets, this would prove key.

Bitcoin, once the plaything of libertarians, is entering a new phase of growth. Entrepreneurs invested in the space speculate that consumer adoption will follow. Many operating in the space who are less politically motivated see rules and regulations as necessary to safeguard users. Given Bitcoin's somewhat notorious reputation, oversight seems inevitable.

The Federal Reserve Bank of St. Louis, held a conference on Bitcoin and crypto-currencies in March 2014. The technology was analysed from a banking viewpoint. Entitled "Bitcoin and Beyond: The Possibilities and the Pitfalls of Virtual Currencies," David Andolfatto, the Vice President of the St. Louis Fed and a professor at Simon Fraser University, outlined how new systems and technologies will bring great change in banking and payments. Mr. Andolfatto noted that: "The threat of entry into the money and payments system [...] forces traditional institutions to adapt or die."

Federal banking regulators have yet to issue guidance or regulations governing how banks are to deal with Bitcoin, outside of the anti-money laundering framework. Under current law, the federal banking regulator with the greatest responsibility over the payment system is the Board of Governors of the Federal Reserve System.

The Department of Homeland Security charged Mt. Gox, which is the Japanese-based largest Bitcoin exchange in the United States, with operating an unlicensed money services business in violation of 18 U.S.C. §1960 and seized its bank account. Subsequently, Mt. Gox filed for bankruptcy in Japan, and on June 14, 2014, a federal bankruptcy judge approved its petition under Chapter 15 of the U.S. Bankruptcy Code, allowing the U.S. bankruptcy court to protect its U.S. assets while the bankruptcy proceedings continue abroad.[6]

While other national jurisdictions seem to be struggling with how to come to terms with this new technology, the U.S. has clearly taken the lead. No doubt regulators will be influenced by the U.S. approach, as it continues to be developed.

New York State[]

On June 3, 2015, New York State became the first state to establish a framework for regulating digital currency businesses when the New York State Department of Financial Services (NYSDFS) issued regulations providing for prudential supervision of virtual currency businesses operating in New York State.[7] Moreover, on May 7, 2015, New York State issued its first virtual currency license to a Bitcoin exchange, itBit Trust Company, LLC, which also received a license to operate as a trust under New York State banking law.[8]

In September 2015, New York granted the first BitLicense application to a virtual currency firm, Circle Internet Financial.[9] On October 5, 2015, a New York license to operate as a trust was issued to a Bitcoin exchange, Gemini Trust Company LLC, which was founded by Cameron and Tyler Winlevoss.[10]

The New York regulations are the result of efforts of the NYSDFS that began in 2014 with the issuance of subpoenas seeking information on a raft of virtual currency issues.[11].

On January 28-29, 2014,[12] the NYSDFS held public hearings on possible regulation of virtual currencies and, on July 17, 2014, issued, for public comment, a proposal to license and regulate virtual currency businesses operating in New York State.[13] A revised proposal was issued in February 2015.[14]

The final regulations require that businesses involved in transmitting, storing, buying, selling, exchanging, issuing, or administering a virtual currency must be licensed by the NYSDFS. Licenses are not required for digital currencies used exclusively in an online gaming environment or for digital currencies that can be redeemed for goods and services, provided they cannot be exchanged for fiat money (such as U.S. currency). Licenses are not required for software developers or merchants investing in virtual currencies or using virtual currencies solely to buy and sell goods and services. A state-chartered bank may be approved by the NYSDFS to operate as a virtual currency exchange without securing a virtual currency license.

The regulations prescribe standards for virtual currency businesses and establish procedures for the NYSDFS to use in approving, suspending, or revoking virtual currency [[licenses. Before granting a license, the NYSDFS must investigate the financial condition, character, and general fitness of any applicant. A license may be granted only when it has been determined that the business will be conducted "honestly, fairly, equitably, carefully, and efficiently . . . and in a manner commanding the confidence and trust of the community.”[15]

The regulations provide the NYSDFS with broad authority to prescribe minimum capital requirements and to subject licensees to any condition deemed “appropriate.” The licensing process requires the submission of detailed information on principal officers, principal stockholders, principal beneficiaries, and members of the board of directors, and fingerprints from certain officers and employees with access to customer funds. Applicants are also required to supply information on banking arrangements; fulfillment of tax obligations; methodology for valuing the virtual currency; and products and services to be offered. The regulation requires regulatory periodic examinations; financial disclosures; and approval of change of control and mergers or acquisitions.

There are anti-money laundering provisions in addition to those required under federal law.[16] Included in the requirements are appointment of a compliance officer and annual compliance audits. cyber security, and anti-fraud requirements, and an array of consumer protection provisions. Customers must be provided with disclosures that address such matters as price volatility; whether transactions are reversible; risk of fraud; liability for unauthorized transactions; and the possibility that future legislation will have an adverse impact. Under the regulations, each virtual currency business operating in New York will be required, before each transaction, to disclose specified information in writing and have the disclosure acknowledged by the customer.

Start-up virtual currency businesses will be able to qualify for a conditional license that would be issued for two years that would be renewable at the discretion of the New York State Superintendent of Financial Services. Before a conditional license is issued, the NYSDFS must consider various factors, including the potential risks and measures to be taken to mitigate them; whether the business is a regulated or licensed financial service provider; and previous business experience of the applicant.

California[]

California has enacted legislation opening the way for virtual currency to be used to purchase goods and services. California Assembly Bill No. 129, signed into law by Governor Jerry Brown on June 29, 2014, repeals a provision of California law that outlawed anything circulating as money other than the lawful money of the United States.[17] In addition, it appears that the California Department of Business Oversight is in the process of considering whether to regulate virtual currency businesses.[18]

Commodity Futures Trading Commission[]

The Commodity Futures Trading Commission (CFTC) first found that Bitcoin (and other virtual currencies) are properly defined as commodities in 2015.[19]

Connecticut[]

On June 19, 2015, Connecticut enacted legislation amending the Connecticut Money Transmission Act to require licenses for all virtual currency businesses operating in Connecticut. The legislation not only subjects them to requirements imposed on money services businesses, such as currency exchanges and money transmitters, it includes provisions establishing additional standards for virtual currency businesses.

The legislation defines "virtual currency business{ to mean "any type of digital unit that is used as a medium of exchange or a form of digitally stored value or that is incorporated into payment system technology." Virtual currency used solely for online gaming and virtual currency that is part of a consumer rewards program that cannot be converted into fiat currency are not covered by the definition.

Under the legislation, virtual currency businesses must maintain a surety bond sufficient to account for the potential volatility of the digital currency. Under the legislation, the Connecticut Banking Commissioner has broad authority to impose conditions when granting a virtual currency license and may disapprove an application upon determining that issuing the license would subject "undue risk of financial loss to consumers, considering the applicant's proposed business model."

Conference of State Bank Supervisors[]

On December 14, 2014, the CSBS issued its Draft Model Regulatory Framework in an attempt to begin a process for states to develop some level of consistency in their approaches to the regulation of virtual currency businesses while emphasizing the need for flexibility. The release of the draft framework was accompanied by requests for public comment on 20 questions that attempted to discern such matters as the extent to which regulatory frameworks that cover money services businesses must be tailored to cover companies handling diverse virtual currency activities. Issues covered in the questions ranged from the advisability of one-size-fits-all regulation to such matters as how to denominate capital requirements — dollars or virtual currency.

After reviewing comments received from the public and conducting consultations with regulators and other stakeholders, the CSBS finalized the draft framework and released the CSBS Model Regulatory Framework for State Regulation of Certain Virtual Currency Activities ("Model Framework") on September 15, 2015. The Model Framework sets a standard for state regulation of virtual currency activities by entities not included in state regulation of depository institutions. It recommends that states adopt laws to cover firms and activities handling virtual currency that parallel their laws governing firms and activities involving sovereign currency.

The Model Framework, therefore, covers firms transmitting virtual currency and firms exchanging virtual currency. It also includes firms providing services to virtual currency transmitters and exchanges, such as purveyors of wallets, payment processors, and merchant acquirers. The Model Framework, however, does not include a special regime for startup companies. Instead, the CSBS advises any state that chooses to include separate arrangements for new companies to devise adequate consumer protections.

The Model Framework's definition of virtual currency begins by stating that "[v]irtual currency is a digital representation of value used as a medium of exchange, a unit of account, or a store of value, but does not have legal tender status as recognized by the United States government." The definition excludes the software employed in virtual currency operations and certain stored value and rewards programs as well as the following types of activities:

- Merchants and consumers who use virtual currencies solely for the purchase or sale of goods or services;

- Activities that are not financial in nature but utilize technologies similar to those used by digital currency;

- Activities involving units of value that are issued in affinity or rewards programs and that cannot be redeemed for either fiat or virtual currencies; or

- Activities involving units of value that are used solely within online gaming platforms and have no market or application outside of those gaming platforms.

The Model Framework embodies a regulatory scheme that is similar to the types of regulation currently applicable under state law to financial firms handling transactions involving U.S. dollars or other fiat money. The Model Framework includes requirements for supervision, examination, and enforcement authority over virtual currency businesses and activities. It specifies that a state's virtual currency regulatory regime should cover licensing, capital and investment standards, consumer protection, cyber security, and compliance standards. Although the Model Framework includes requirements for surety bonds, it does not require cyber insurance.

References[]

- ↑ Virtual Currency Schemes, at 6.

- ↑ Virtual Currencies: Key Definitions and Potential AML/CFT Risks, at 13 n.2.

- ↑ The current price of a Bitcoin can be obtained from Bitcoin-Charts.

- ↑ Because the supply of Bitcoins is fixed in the long run, sustaining the payment of Bitcoins tominers for providing verification services will be impossible. Without that subsidy, the Bitcoin network arguably could face rising transaction costs and a diminished attractiveness when compared with traditional centralized payment systems.

- ↑ Joshua Brustein, "Bitcoin May Not Be Anonymous After All," Bloomberg Bus. Wk. (Aug. 27, 2013) (full-text).

- ↑ Michael Balthon, "Mt. Gox U.S. Bankruptcy Approved to Help Bitcoin Hunt," Bloomberg News (June 17, 2014) (full-text).

- ↑ New York Department of Financial Services, Superintendent Benjamin A. Lawsky, "NYSDFS Announces Final Bitlicense Framework for Regulating Digital Currency Firms,” speech (June 3, 2015) (speeches/sp1506031.htm full-text) (contains a link to New York Codes, Rules and Regulations, Tit. 23, Ch. I, Regulations of the Department of Financial Services, Part 200, Virtual Currencies.)

- ↑ New York State Department of Financial Services, press release, "NYDFS Grants First Charter to a New York Virtual Currency Company" (May 7, 2015) (full-text).

- ↑ New York State Department of Financial Services, press release, "NYSDFS Announces Approval of First Bitlicense from a Virtual Currency Firm" (Sept. 22, 2015) (full-text).

- ↑ New York State Department of Financial Services, press release, "NYSDFS Grants Charter to ‘Gemini’ Bitcoin Exchange Founded by Cameron and Tyler Winkelvoss" (Oct. 5, 2015) (full-text).

- ↑ New York State Department of Financial Services, "Notice of Inquiry on Virtual Currencies" (Aug. 12, 2013) (full-text).

- ↑ See http://www.dfs.ny.gov/about/hearings/vc_01282014_indx.htm.

- ↑ New York State Department of Financial Services, Proposed Regulations Submitted for a 45-Day Notice and Comment Period to Solicit Public Feedback (full-text).

- ↑ The text of the original proposal, the revised proposal, and the final regulations, together with public comments, may be found at the New York Department of Financial Services website.

- ↑ NYCRR, Tit. 23, §200.6; 37 N.Y. Reg. 7 (June 24, 2015).

- ↑ See Raveena Benepal, "Money Laundering Emerges as Contentious BitLicense Provision," Bloomberg BNA Banking Daily (July 29, 2015).

- ↑ See (full-text).

- ↑ See California Department of Business Oversight, "What You Should Know About Virtual Currencies" (Apr. 22, 2014), and "DBO Commissioner Owen Clarifies Coinbase Exchange’s Regulatory Status in California" (Jan. 27, 2015). The latter states that "The California Department of Business Oversight has not decided whether to regulate virtual currency transactions, or the businesses that arrange such transactions, under the state's Money Transmission Act." Both are available (001779225245372747843%3Ayckvhkzkpng&cof=FORID%3A10&ie=UTF-8 full-text).

- ↑ In the Matter of Coinflip, Inc., d/b/a Derivabit, and Francisco Riordan, CFTC Docket No. 15-29 (full-text).

Sources[]

- "How ir Works" section: Dark Web (CRS Report), at 11.

- Bitcoin: Questions, Answers, and Analysis of Legal Issues

- Virtual Economies and Currencies: Additional IRS Guidance Could Reduce Tax Compliance Risks, at 5.

See also[]

- Bitcoin Exchange

- Bitcoin Foundation

- Bitcoin: Questions, Answers, and Analysis of Legal Issues

- Bitcoin: Ultimate Beginners Guide

- Virtual Currencies: Emerging Regulatory, Law Enforcement, and Consumer Protection Challenges

- Virtual Currency Schemes

External resources[]

- Bank of England, "The Economics of Digital Currencies," Quarterly Bulletin (Q3 2014) (full-text).

- Bitcoin (full-text).

- Jerry Brito & Andrea Castillo, "Bitcoin: A Primer for Policymakers," Mercatus Center, George Mason University (2013) (full-text).

- Senate Committee on Homeland Security and Governmental Affairs, "Beyond Silk Road: Potential Risks, Threats, and Promises" (full-text).

- Senate Committee on Banking, Housing, and Urban Affairs, "The Current and Future Impact of Virtual Currencies" (full-text).

- François R. Velde, "Bitcoin: A Primer," Chicago Fed Letter, No. 517 (Dec. 2013) (full-text).